The last time Valsef Capital published an article was on XPO Logistics (NYSEMKT:XPO) in 29 March 2012 and XPO Logistics has since returned 202%. The Redknee Solutions (OTC:RKNEF) (Redknee Solutions is listed in the Toronto Stock Exchange) investment opportunity seems equally if not more compelling. Our thesis is as follows.

Redknee Solutions Investment Thesis:

Redknee Solutions is a software company that generates revenue from mission critical software used by Telecom clients around the world. Redknee's solution set provides Business Support Systems (BSS) namely; billing, charging, customer care and payments solutions for voice, messaging and data services (Product/Customer/ Revenue/Order management).

Recent developments since December 2016 have resulted in a special situation opportunity. At the core of this thesis is ESW Capital, a Joe Liemandt investment company that has been acquiring and operating software businesses for over 30 years, with a specialization in turnarounds and restructuring. ESW Capital is part of a larger group of companies that include Trilogy (one of the largest privately held software businesses), Versata and Aurea forming three of the largest operating businesses.

Under ESW Capital's operating model (based on the group's history of value creation), Redknee is capable of operating at 40%+ Ebitda margin. Consequently, at a conservative 8x Ebitda/EV multiple, Redknee should trade at CAD $2.00 = 100% return over the next two years.

The Thesis is structured as follows:

- Understanding ESW Capital, its founder/CEO Joe Liemandt, Trilogy, Versata, Aurea and its group of companies

What is ESW Capital? What does it achieve after acquisition? How does it achieve 40% Ebitda margins with software turnarounds? What is the process?

- ESW Capital's success with public software companies

- Upland Software (NASDAQ:UPLD) + ESW Capital = 105% return from 2015 low.

- A comparison: ESW Capital Vs. Constellation Software (OTCPK:CNSWF) (Canada's best software acquirer) - CSU has generated 3,400% return since IPO (2006)

- The Redknee Business: Built by two acquisitions

- Recent Developments at Redknee

- Before Preferred shares deal

- After Preferred shares deal: (Share price depressed by poor investor communication from newly appointed ESW Capital Board/CEO)

- What is Redknee Solutions worth?

- Risks

Understanding ESW Capital, its founder/CEO Joe Liemandt and Trilogy group of companies

ESW Capital is an expert software operator and prudent capital allocator masked under poor stock performance of Redknee Solutions. It is arguably among the best in software turnaround situations.

A deep understanding of ESW Capital will provide confidence in investing along with it. What is not obvious is the lack of detailed investor communication which is arguably the main reason for loss of investor confidence in the stock.

ESW Capital lists Trilogy (June 1989) as the first company in its portfolio of companies, followed by Versata (acquired in January 2006). Below is the ESW Capital story.

Trilogy Software Inc.

The roots of ESW Capital date back to 1989 when Joe Liemandt, current CEO of ESW Capital dropped out of Stanford with a few Stanford classmates to start Trilogy Software. Over the next 10 years, Trilogy went onto become one of the largest software companies of that time. It is still one of the largest privately held software companies. By the late 1990s, Trilogy had 1,200 employees and revenue over USD$250 million. In a one-hour talk to Stanford students in 2005, Joe Liemandt explains his passion for entrepreneurship; how Trilogy was built on a stack of credit card debt and how it went on to serve large clients such as Boeing (NYSE:BA), HP (NYSE:HPQ), AT&T (NYSE:T) and GE (NYSE:GE).

Joe Liemandt understood software pricing power very early

- In the start-up days of Trilogy, it pitched its Configuration software to many telecom and computer companies. Silicon Graphics was among one of the fast and upcoming innovators of that time. Silicon Graphics was initially interested in Trilogy's software, but did not have the confidence in putting a mission-critical process in the hands of a bunch of kids. So it backed off.

- However, in a few months, Silicon Graphics came back to Trilogy because there was no comparable solution in the market. It became Trilogy's first client. Joe Liemandt charged SGI $300,000 for the software, which three months ago had a $100,000 price tag. Joe Liemandt and his team realized that when a large company comes to a startup for a mission-critical process it is because it has no alternate option - Now you have tremendous pricing power.

- When HP came knocking on Trilogy's doors for the configuration software, Joe Liemandt charged it $3 million. Then AT&T came along and Trilogy charged $7.5 million. When IBM (NYSE:IBM) came along in 1995, Trilogy charged it $25 million - to become the most expensive software sale in history.

- Joe Liemandt Podcast - Stanford talk to students in 2005 is a must see.

- Trilogy Software went on to become one of the biggest privately held software companies. The business was so successful that Harvard Business School built case studies about Trilogy.

- Harvard Business School Case Study on Trilogy (1998)

Trilogy Stumbles, But ESW Capital Reinvents Itself

All along the early growth phase, Trilogy went on an aggressive hiring spree. In fact, it went on to create Trilogy University. Liemandt said at the time that: "Trilogy University cost $3 million a month to run, but money wasn't an issue". (Source: statesman.com)

Along came the dot.com bust and Trilogy too went through a rough period. Overall software spending took a back seat, so did Trilogy's enterprise software. In the same talk to Stanford students in 2005, Joe Liemandt explains how he had to restructure and reposition the company which included building an offshore talent center in Bangalore, India which cost him a fraction of the cost of hiring software talent in North America. The foundation for ESW Capital, its acquisition strategy and its new operating model, was being established along with the repositioning of Trilogy Software. In 2012, Trilogy was said to have 10,000 clients in 45 countries.

ESW Capital's Acquisition Strategy Takes Off

On January 2006, Versata (a public company at that time) was taken private by Trilogy. It was followed by a merger of portions of Trilogy, specifically, Trilogy Technology Group, into Versata with a focus on acquiring software companies that need restructuring.

Since 2006, Versata has done 20+ acquisitions specializing in restructuring underperforming or "broken" software businesses. Newly appointed CEO of Redknee, Danielle Royston has been CEO of Versata since 2009 and is CEO of about 18 companies that come under Versata.

Versata Acquisition/Operation Model

- Acquire sticky revenue base businesses, where the software and associated support services are mission critical in nature Revenue Rationalization: Divest, discontinue non-profitable revenue segments and non-profitable clients: This is a best practice followed by serial acquirers in software - Constellation Software, Enghouse Systems (OTC:EGHSF), SS&C Technologies Holdings (NASDAQ:SSNC), CGI Group (NYSE:GIB) to name a few.

- Bottom line: Gross margin increases along with overall profitability

- "Customer Success Program": Significantly improve focus on existing customers; improve their satisfaction rate (leads to better retention), up-sell/cross-sell additional software modules to existing clients. Realign pricing of software systems, modules and services based on improved value proposition provided to clients. Bottom line:

- Existing revenue is more profitable after acquisition

- Revenue and customer retention is higher post restructuring

- Sales and marketing expense is significantly lower with focus on internal sales (existing customers)

- General & administrative expenses are also lower but to lesser extent than sales & marketing

- All these savings drop straight to the bottom line.

- Cost Reduction/Rationalization: Joe Liemandt is the founder of DevFactory (a company that provides software and technology talent from India at much lower cost than a comparable software engineer or support staff in North America or Europe. Founded in 2007). So what does Versata do for cost rationalization?

Estimate minimum number of employees required to support business locally. Move a meaningful portion of them to contractors and ask them to work from a home office.

- The benefits to cost reduction include; low/no office costs and other overheads of having employees

- For the remaining employees, Versata replaces them with contractors from around the world through DevFactory

- All shared services in an acquisition - namely HR, Finance & Accounting, Admin are removed and sent to the shared resources across ESW Group of companies. An example of the level of "sharing" is below:

- Crossover (another ESW company) shares the same address as other companies: DevFactory, Ravenflow, Trilogy, gTeam, Ignite, TriActive, Metatomix, Versata and Nuview. They all share the same suite in Austin (401 Congress Ave Ste 2650, Austin, Texas) as per bizapedia.com

- In fact, there are 52 companies listed in bizapedia under Aurea and Crossover address

- Another example is "Robin Rosi" who is senior executive assistant at Aurea Software and Crossover (both ESW companies)

- In 2014, Trilogy Software spun-out Crossover Inc. to compete directly with oDesk. Crossover uses software that connects customers with remote workers globally, coupled with a suite of online tools that enable users to manage distributed workforces.

- Andy Tryba CEO of Crossover said about 70 percent of its business is from software developers with the remaining contractors working in customer support, marketing and finance positions. The company generates revenue by taking 10% of what its customers pay the contract workers.

- Crossover (another ESW company) shares the same address as other companies: DevFactory, Ravenflow, Trilogy, gTeam, Ignite, TriActive, Metatomix, Versata and Nuview. They all share the same suite in Austin (401 Congress Ave Ste 2650, Austin, Texas) as per bizapedia.com

Versata processes are typically in place in 6-12 months, in shorter time durations for smaller companies.

From our checks with industry consultants, we have come to know that Versata companies operate at Ebitda margins in the 40-50% range (in some case even higher). The processes described under "Versata Acquisition/Operation Model" highlights how it achieves high profitability in a short time.

Aurea

- In addition to Versata, in October 2012, ESW Capital acquired four Progress Software businesses - Sonic, Savvion, Actional and DXS to form Aurea. Upon formation, Aurea Software had over 1,500 customers worldwide supported by a global team of 250 people and revenue of approximately USD$100 million. Scott Brighton, chairman of the Board of Redknee has been the CEO of Aurea since 2012 and was part of Trilogy since 2001. Aurea is another book of business for ESW Capital and uses many of the same processes and infrastructure used by Versata to provide industry leading profitability for its acquisitions.

- Since 2012, Aurea under Scott Brighton's leadership has acquired eight software businesses with revenue estimated to have at least doubled. In the words of one of its current employees, "Aurea's technology is behind some of the world's greatest customer experiences like Walt Disney and British Airways."

- Aurea has a higher focus on organic growth than Versata.

The ESW Capital group includes Trilogy, Aurea, Versata, DevFactory and Crossover with Joe Liemandt as the key decision maker across the group. Versata's CEO Danielle Royston specializes in turnaround operations, while DevFactory and Crossover specialize in providing world-class technology talent at lower costs than in North America and Europe.

What is DevFactory?

DevFactory started with Trilogy realizing that India has talent comparable to North America, but at a much lower cost. This outsourcing model was expanded to Ukraine and China. However, over time, all of DevFactory employees were asked to join as contractors via oDesk. Today, that process has evolved into:

"A low cost delivery model that enables project tasks to be done by a geographically dispersed network of service providers."

ESW Capital & Upland Software Inc.

Redknee Solutions is in fact the second time ESW Capital has invested in a public company. The other public company is Upland Software. Publicly available information shows that ESW Capital owns 31.82% of Upland Software. ESW Capital increased its position from 2.5 million shares at IPO in 6 November 2014 to about 5.5 million shares today, with aggressive buying as the shares fell.

In fact, ESW Capital and Upland Software have another connection. On March 14, 2016, Versata (an ESW Capital company) bought EPM Live from Upland. The press release regarding acquisition says the following:

"Integration will begin with implementation of Versata's Customer Success program, a proven method for driving successful customer relationships and alignment of product development investments with customer priorities."

Veteran Versata executive Danielle Royston will take on the role of CEO for EPM Live. "I am pleased to lead EPM Live into the future with its world-class customers and innovative products. Moving forward, we will create even more value for EPM Live customers by advancing product development, enhancing support and instituting a near obsessive focus on customer success," Royston said.

The Upland Software Story

Upland Software is a leading provider of cloud-based Enterprise Work Management software that helps organizations to plan, manage and execute projects and work. Upland was built through acquisitions but the initial focus was to position the company for organic growth through these acquisitions; but that changed quickly once the share price dropped from $11.00 at IPO to about $6.00 in three months - 40%+ drop.

Throughout the IPO process, and the first quarter after IPO (Q4, 2014) Upland was focused on gaining scale to drive organic growth.

John T McDonald CEO, Upland Software Q4, 2014: - First Call as public company

"We remain committed to our goal of acquiring an additional $20 million of run rate revenues this year, again"

"As you know, we're focusing on getting the businesses scale and we believe that M&A is the most efficient way to get to scale at this stage and we're always looking to buy companies that can grow 10% plus organically."

"As we achieve scale and start - we'll start to focus more and more on organic growth in the future as the M&A portion of our growth decreases over time."

Within the next quarter (Q1, 2015) Upland changed focus to improving Ebitda and profitability.

John T McDonald CEO, Upland Software Q1, 2015 Earnings Call:

"So if you took - and we'll only do acquisitions if they're EBITDA accretive within the first year, post acquisition."

John T McDonald CEO, Upland Software Q3, 2015 Earnings Call:

"We are looking at 58% sequential - quarterly sequential growth in EBITDA and 94% increase year-over-year."

"So again, strong EBITDA quarter, strong EBITDA guidance for Q4"

"As you know, we are de-emphasizing the lower margin parts of the business, including professional services." - Similar to Redknee Solution's new revenue visibility number of $120 million given by ESW Capital.

"I'd just say, Bhavan (sell-side analyst), that the emphasis going forward is growing EBITDA"

"We're also looking at acquisitions that are going to be accretive to EBITDA to adjusted EBITDA within the first year that they are purchased"- The focus earlier as in Q4, 2014 call was to grow revenue (by $20 million) gain scale and focus on organic growth as Upland becomes bigger.

Upland Raises Ebitda Guidance Consistently

- In 2015, Upland improved Adjusted EBITDA margins from 2% in Q1 to 10% in Q4

- March 29, 2016: Adjusted EBITDA margin of 11% guides for 20% Q4 2016 Ebitda margin

- January 11, 2017: Raised its long-term Adjusted EBITDA margin target from 30% to 35%.

There is strong reason to believe that Upland's change in business strategy is driven by ESW Capital's growing relationship as the biggest shareholder. At the least, there is clear proof that an ESW Capital public investment can move from losing cash to profitability in less than 12 months.

Upland Software Uses DevFactory (a ESW Capital company)

As per Upland's filings, 11,000,000 shares of common stock were issued to DevFactory based on an agreement the two companies had in the past. Upland continues to use DevFactory to its benefit.

John T McDonald CEO, Upland Software Q3, 2016 Earnings Call:

"We measure that success using industry standards like net promoters score or NPS as it's known, by surveying our customers twice a year and redirecting that feedback into further operational improvements and we're heartened by our progress and our level of customer loyalty."

Interestingly, the customer satisfaction survey is a feature that was used by Trilogy where Trilogy gets paid only if the customer gets value (a % of incremental revenue or cost saving that Trilogy is able to drive).

"Our premier success program, our customer-informed product road maps, our quality-driven R&D that leverages the DevFactory platform and our enterprise class cloud and operating platform.

"use DevFactory platform, to drive quality-focused R&D"

"The results they deliver are clear, they're rallying point for our team internally, they drive top and bottom-line growth through strong renewals and expansion sales and customer references that support efficient new customer sales and thereby drive shareholder returns" "We have also improved the efficiency of our sales and marketing organization by reducing cost while exceeding quarterly bookings target." - How is this possible?

This is from Crossover.com website (Crossover is a ESW Capital company): "Crossover teams will deliver a 50% improvement at a 50% cost reduction to your current teams in under a quarter."

Sell-side analysts are surprised how Upland can provide such rapid margin expansion. Here is a question from a Q3 2016 call.

Richard Baldry, Analyst:

"I guess I'm a little surprised that the number of data centers and offices can be consolidated both maybe this quickly and down the numbers are coming down to. Can you talk about -- was that -- did you expect it to be that easy to pull it down between your headcount challenges, personnel, I guess? Do you think you can get it further still, or do you think you get to a certain level, you know we need to be geographically representing these areas so it doesn't make any sense, you could push really much further than where we're at?"

John T McDonald CEO, Upland Software:

"Again, it's a purposeful by-product of the model that we've built here, which is a customer center model where we have a core common set of processes [ph] right, around all the products. So it's one orders and renewables team, one account management team, a consistent premier success offering across all of our products, one R&D platform, where we're leveraging third-party platforms like DevFactory to help reduce our headcount, increase our efficiency, have more automated testing, improve quality."

"One 24/7 global customer support operation -- again supporting all products -- and then efficiency on the sale side as well. We haven't talked as much about that, but using and leveraging low cost inside sales and then a small SWAT team of enterprise sales people that can really do rolodex, they selling and leverage strong customer references where we need to penetrate new accounts and even those sales people are going to be focused principally on the great opportunity we see in larger expansion deals inside our fortune 2,000 account."

"We love the model, it takes time to get it all in place and at 75 million roughly of revenue, I really start to see it coming together. I think it's an inflection point for the business and now it's about growing the top line both organically and executing against a more aggressive M&A schedule over the next year or two. And again, you never know what M&A's exact timing and that kind of thing, but we've got the platform, we've got the resources to do it and we're optimistic."

Confirming DevFactory Competitive Advantage

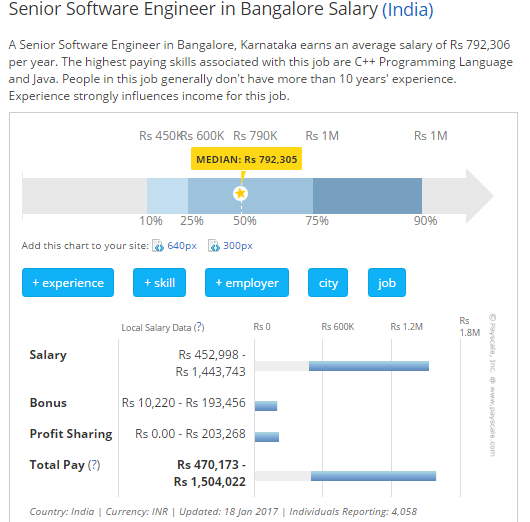

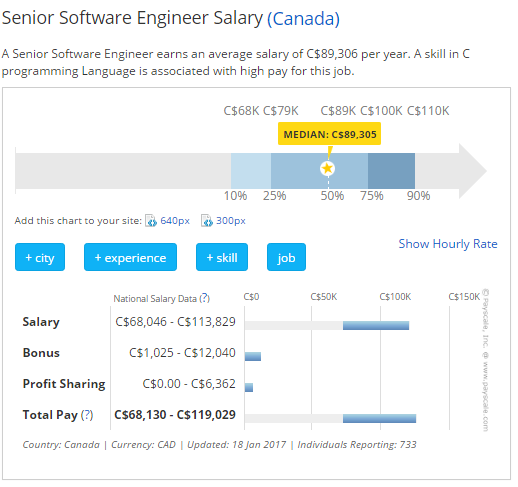

A look at the range of salaries from payscale.com for senior software engineers from India confirms Upland Software's explanation on DevFactory. At current USD/INR = 66.6 the median salary is USD $10,950 to USD $15,015. A same software engineer median salary in Canada cost $67,692 USD. The median salary of software engineers in Canada is higher than the high end of the range in India by a factor of 4x. While there is a reasonable range in salary based on talent and specific skill sets, our checks with industry consultants also confirm that the largest recruiters of software engineers in India namely; Infosys (NASDAQ:INFY), TCS (OTC:TTNQY), Wipro (NYSE:WIT), HCL Technologies (OTC:HCTHY) compare with the range shown on payscale.com

>>All facts point to ESW Capital/DevFactory contributing tremendously to Upland's success<<

>>Upland stock price is up 105% after renewed profitability focus<<

>>Will Redknee Solutions be the next Upland Software<<

The Redknee Business: Built by 2 significant acquisitions

Redknee's software solutions provide Business Support Systems (BSS) predominantly for communication service providers (CSPs). This includes but is not limited to;

- Billing, charging, customer care and payments solutions for voice, messaging and data services (Product/Customer/ Revenue/Order management)

The software is used by over 250 operators in over 100 countries, representing 24B transactions per day. The mission critical nature of the software makes the revenue "sticky".

Growing revenue through acquisitions, but losing Cash

From 2008 to 2012, Redknee hovered around USD$50 million in revenue. Founder/CEO Lucas Skoczkowski believed that given the relative small size of the Redknee business, they did not have the scale and infrastructure to build a global, sustainable, profitable business. To remedy that, under CEO Lucas Skoczkowski's leadership Redknee made two transformational acquisitions - (1) Nokia Siemens Networks BSS acquisition (June 2013) and (2) ORGA Systems acquisition (October 2015). Redknee's stated long-term strategy to use acquisitions to:

- Expand and evolve business-critical solutions for our global customer base

- Grow market share & leadership in our addressable market

- Continue to increase sustainable recurring revenues

- Set long-term goal of $1B revenue and $200 million Ebitda margin (wanted to challenge Amdocs (NYSE:DOX) a publicly traded direct competitor in a hurry)

(1) Nokia Siemens Networks BSS Acquisition (June 2013)

Redknee bought Nokia Siemens Networks business for

- 130+ communication service provider customers

- 90 countries throughout Asia Pacific, Middle East, Africa & Europe

- Strong Tier-1 clients

- 2B mobile subscriptions provisioned on Redknee's systems

- Employees: 1,200

- 2012 Revenues: $226.8 million vs. $252.5 million (2011)

- Recurring Revenue ($) = $100.8 million, 44% of revenue

- Purchase Price:

- $4.6 million in cash paid for certain NSN net working capital

- Estimated €25 million performance based payout over ~12-36 months

- Assumptions at time of acquisition

- 10-15% decline in annualized revenue while the business is stabilized over the next 12 months

- Reduced headcount primarily in COGS and R&D

- NSN BSS business has been restructured in 2012

- Goal:

- Targeting positive single-digit EBITDA margins in next 12 months

- Result after 12 months:

- Revenue loss is higher than expected

- 2015: Revenue totaled $222.7 million ($246.3 million, on a constant currency basis) compared to $257.7 million

- Revenue loss is higher than expected

Reason for these poor results: "Poor Execution"

- Unable to improve up-sells/cross-sells and improve product pricing through improved software services

- Management underestimates level of restructuring required and is unable to make aggressive changes. Management has no previous experience in turnaround situations.

- Management starts looking to other verticals outside of Communication Service Providers when the focus should have to get to profitability

(2) ORGA Systems Acquisition (October 2015) - Makes things worse!

Acquired from German insolvency process; cost structure reduced prior to close of the acquisition

- Financed from cash on the balance sheet

- 45 customers added

- Customers in smart energy, connected car, and transportation markets

- 546 employees

- Revenue: $40 million in run-rate revenue, $20 million in recurring revenue

- Net loss of $29.6 million in 2014, net loss of $16.5 million, six months ended June 2015.

- Purchase Price:

- $42.3 million in cash, 2x recurring revenue

- No earn-out

- Goal:

- Leverage additional scale to generate cost synergies

- Accelerates Redknee's expansion into additional enterprise markets, drive meaning cash flows

- Result after 12 months:

- Revenue loss accelerates

- Revenue totaled $171.1 million compared to $222.7 million the year before

- Reason for these poor results:

- Management does poor job of estimating revenue churn, unable to sell new modules, improve pricing

- Management severely underestimates level of restructuring again. Unable to make aggressive changes

- Management increases focus on other verticals outside Communication Service Providers when the focus should have to get to profitability

- Revenue loss accelerates

>>Despite meaningful "recurring revenue" management was unable to generate free cash flow<<

>>Poor Management leads to Breach of Debt Covenant<<

2016: Breach of Debt covenant & Strategic Review

- August 4, 2015: Redknee entered into credit agreement to strengthen its working capital position following the acquisition of Orga Systems, to position Redknee for future growth

- December 31, 2015: $59 million was outstanding under the Credit Agreement

- February 10, 2016:

- Announced restructuring, with expected cost of $25 million to $30 million

- Announce delays in several customer purchasing decisions

- April 11, 2016: Lenders agree to an amendment to the Credit Agreement such that the Company would not breach the financial covenants

- June 2016: Lenders entered into a waiver and amendment of the Credit Agreement pursuant to which the lenders waived the potential breach of the financial covenants

- August 10, 2016: ESW Capital announced that it had acquired 12,500,000 Common Shares, = 11.55% of Redknee at an aggregate cost between CAD$1.50 and CAD$1.70 per Common Share.

- August 22, 2016: Redknee Solutions Announces Formation of Special Committee to Review Strategic Alternatives

- The lenders give debt repayment deadline. Redknee to complete the transaction pursuant to such agreement and repay all amounts outstanding under the Credit Agreement by January 31, 2017.

- December 9, 2016: Announces USD$80 million Private Placement with Constellation Software. The Warrant will entitle the Investor to acquire a number of Common Shares (each a "Warrant Share") equal to USD$120,000,000 divided by the exercise price per Warrant Share (the "Warrant Exercise Price") for a period of 10 years from the Closing Date.

- December 19, 2016: Redknee Solutions Inc. Announces Receipt of Superior Proposal and Commencement of Matching Period from ESW Capital. $80 million in preferred shares, $3.2 million in termination fee for Constellation and a warrant that would entitle ESW Capital to acquire a number of common shares (each a "Warrant Share") equal to USD$60,000,000 divided by the exercise price per Warrant Share (the "Warrant Exercise Price").

- January 26, 2017: Redknee Announces Closing of Private Placement from ESW Capital and Changes to Board of Directors.

Superior Offer from ESW Capital

Under the Constellation Agreement, the Company would have completed a private placement of 800,000 Preferred Shares and a common share purchase warrant to the Constellation Investor for gross proceeds of USD$80 million. However, the Warrant to be issued to the Investor under the ESW Agreement will be exercisable to acquire a number of Warrant Shares that will result in fifty percent (50%) less dilution to shareholders as compared to the warrant that would have been issued under the Constellation Agreement.

- Preferred Shares have a 10% interest that needs to be paid quarterly

Constellation Software Vs ESW Capital

Constellation Software founded in 1995 is one of the best capital allocation stories in the software businesses and CEO/Founder Mark Leonard is a standout "Outsider" at par with the greats in the widely famous book "The Outsiders" by William N. Thorndike.

- Constellation Software's track record is as follows. Stock price appreciation since IPO in 2006 = 3,400%, last 10 years = 2,500%, 5 years = 585%. Mark Leonard and his team are not done yet.

- Constellation buys vertical software businesses with a razor focus on price as a function of its recurring revenue base and quality of business defined by revenue/customer retention. President's letters from Mark Leonard is a class in session regarding software acquisitions and incentive alignment for all employees so as to create long-term sustainable shareholder value.

- Constellation buys both turnarounds and moderately growing businesses. However, unlike ESW Capital, Constellation Software is an extremely decentralized software roll-up story with over 200 operating business units under it.

- As a result, each of the business units is a capital allocator looking to buy a business under its operation. This gives Constellation the ability to go after really small acquisitions which most companies its size won't pursue.

- In contrast to ESW Capital where operations and decision making is centralized, Constellation relies on individual entrepreneurship over centralized cost rationalization.

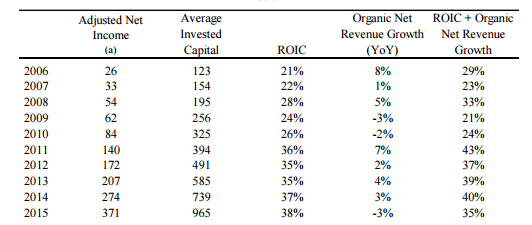

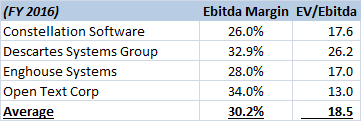

- However, as a result of decentralized operations, there is less to no operational leverage across the different business units. As a result, Constellation operates at 25% Ebitda margin and a high ROIC (return on invested capital) of 35%+ starting 2011. Table below is a summary of the company's operating performance since IPO.

- Given the size of Constellation Software and ESW Capital today, they are increasingly presenting competing bids to buy software companies. In fact, both companies showed interest to buy Bond International (a UK-based recruitment software company) in 2016, but was eventually bought out by private equity firm Symphony Technology Group.

Constellation software was the first bidder for Redknee Solutions. This illustrates the following:

- Constellation believes Redknee has a sticky revenue base

- Constellation believes under the right management Redknee can meet Constellations return expectations - 25% Ebitda margin, ROIC of about 35%.

- Unlike ESW Capital, Constellation Software is a well researched, well documented success story and its interest in Redknee should give investors confidence in the underlying business

A Summary Of Events So Far

>> Debt concern alleviated <<

>> Top turnaround team (ESW Capital), manager (Danielle Royston) join Redknee"

>> Share price decline since ESW Capital = 44%. <<

>> Despite a series of Value creating events! What happened? <<

Answer: Poor investor communication!

A look at Redknee Investor Communication - After ESW Capital Preferred Shares Deal

- January 26, 2017: Redknee Announces Closing of Private Placement and Changes to Board of Directors.

- February 15, 2017: Redknee Solutions Inc. Announces Changes to Board of Directors and Executive Leadership.

- February 23, 2017: Redknee Announces New Strategic Plan for Long-Term Growth and Sustained Profitability.

- February 23, 2017: Redknee Solutions Inc. Provides Statement on Sale of Company Stock.

While all the events that took place are value creating in nature. The seems to be a critical feature of capital markets that ESW Capital missed completely -"Clear Investor Communication = Investor Confidence"

Valsef Capital Research Vs. Street Research - Closing the Gap

ESW Capital is a relatively unknown entity. Beyond ESW's website and the portfolio company websites, there is very little information that is readily available.

- ESW Capital CEOs and leaders are also low profile. There is not much information available about Danielle Royston (CEO, Versata), Scott Brighton (CEO, Aurea) and Andy Price (CFO, Trilogy Software). In fact, the only person from the group that has public information is Joe Liemandt and this is dominated by his early Trilogy days, Stanford related news and Harvard Case Studies; not about the his second innings of acquisitive business model.

- However, Valsef Capital went beyond traditional research to interview industry consultants who specialize in turnarounds and some of them were past employees of Trilogy, Aurea, Versata and DevFactory. Valsef also has a subsidiary (Valsoft Inc.) that buys software businesses similar to ESW Capital and Constellation Software. In an effort to build Valsoft, Valsef Capital has been studying successful acquisitive software models for five years and has known and studied ESW Capital for 3+ years.

- The other venue to learn about ESW Capital is through Upland Software. However, Upland is relatively small company and has itself undergone a turnaround in the last two years. Moreover, it is only in the Q3 2016 that Upland states DevFactory and color around it. Valsef has known about Upland since it went an IPO road show.

- It is through the collective knowledge of understanding ESW Capital over last 3+ years, Valsef's knowledge of Upland from its IPO days and Valsef's acquisitive software business Valsoft that this "Redknee Thesis" was formed.

Current "Poor" ESW Capital Communication Regarding Redknee

ESW Capital has been known to not waste time and get things done quickly. While this is a great business trait, it got the better of management & board; resulted in poor communication (probably in the interest of doing rather than speaking); which in turn caused utter loss of investor confidence. In mere three press releases the stock was beaten down 35%+ and with valid reason. The three press releases and the flaws in each of them are discussed below.

January 26, 2017: Redknee Announces Closing of Private Placement and Changes to Board of Directors

- This is a pivotal moment for Redknee shareholders; majority of whom voted in favor of the ESW Capital proposal. There was keen interest in learning more about the ESW Capital team and its ability to turn things around. However, the first press release after ESW Capital took over the board had no detail about the group whatsoever.

February 15, 2017: Redknee Solutions Inc. Announces Changes to Board of Directors and Executive Leadership.

- Incumbent CEO Lucas Skoczkowski was removed and Danielle Royston was appointed.

- Scott Brighton: "The Board sees enormous long-term potential for Redknee, and to capitalize on that long-term potential we must undertake aggressive changes in the short-term to fix the fundamentals of the business. Danielle Royston is an exceptional software executive who has been the architect of numerous turnarounds. We thank her for accepting this important role."

- Capital Market's Best Practice: While there is mention of Danielle Royston's success in turnarounds. There is no further detail. Investors are not told if she will continue to be a Versata CEO. This is an ideal time to explain ESW Capital's expertise in turnarounds. A mention of Upland and its use of DevFactory and other ESW Capital infrastructure to improve profitability from single-digit Ebitda margin to 35% Ebitda margin would have been reassuring.

Investor Communication Turns From Bad to Worse: "Investor confidence crushed"

February 15, 2017: Redknee Announces New Strategic Plan for Long-Term Growth and Sustained Profitability

- Revenue visibility stated as $120 million from 2016 revenue of $158 million, with no color around why so?

- Press release says $60 million in capital required for restructuring but does not say what it is being used for, how much there will be in savings as a result

Capital Markets Best Practice: Public companies typically announce such material changes in strategy and restructuring with a "Business Update Call". In the call management and sometimes the Board give investors more details about the strategic plan. However, in this case the announcements were complete opaque.

- ESW Capital needs to showcase better judgment and corporate governance. This lack of communication combined with the news of a capital raise spooked investors. Had investors known its capacity to operate businesses at 40%+ Ebitda margins Redknee stock would have likely moved up not down.

- Sloppy communication misrepresents ESW Capital as amateurs in business. However, that would be far from reality.

What is Redknee Solutions Worth?

Valsef's valuation of software businesses is based on a combination of two factors (1) our experience in assessing great software companies in the public market and (2) buying software companies the way Constellation Software buys them - as a function of recurring revenue and recurring revenue retention/customer retention. The general Constellation principle is that if a "sticky" vertical market software business (most of them are "sticky" by virtue of being very vertical specific) is bought under 2x recurring revenue, a good operator such as itself can make handsome returns and not too much can go wrong.

- Redknee had recurring revenue of $95 million, $92.6 million and $116.4 million in 2016, 2015 and 2014, respectively. The drop from 2014 to 2015 was the result of some expected churn from the Nokia (NYSE:NOK) acquisitions. At current price of CAD$1.00 Redknee is trading at about 1x EV/Recurring revenue. A price at which Constellation Software would be clear buyer. It is also 42% below the warrant exercise price.

- For the purpose of comparison, Canadian software companies trade at fairly high multiples of revenue and Ebitda when compare to Redknee. Given the focus is on profitability, below is a table of the largest software companies in Canada.

Amdocs - A Redknee Solutions Competitor

- Amdocs provides integrated customer care and billing systems for telecom companies. In fact, Redknee went on an acquisition spree to catch up to Amdocs and other larger competitors.

- Amdocs has a gross margin of 35% compared to Redknee's 53% in 2016. Yet Amdocs operates at an Ebitda margin of 20%.

- 2016 Revenue = $3.7B

- Amdocs has operated at comparable operating margins since 2005

- How did Amdocs perform during and after the financial crisis (2007- 2008)? - A measure of the quality of the industry Redknee operates in

- Amdocs revenue dropped 9.5% in 2009 and recovered in 2010 with a 4.2% growth. The company has been maintaining positive revenue growth and stable profit margins for over a decade.

- Revenue growth is aided by tuck-in acquisitions funded by free cash generated by the company and organic growth. Capex requirements are modest, while working capital requirements are low.

- Amdocs revenue dropped 9.5% in 2009 and recovered in 2010 with a 4.2% growth. The company has been maintaining positive revenue growth and stable profit margins for over a decade.

- Amdocs trades at EV/Ebitda = 11.5x

- Amdocs has a gross margin of 35% compared to Redknee's 53% in 2016. Yet Amdocs operates at an Ebitda margin of 20%.

A recent Canadian restructuring example: Halogen Software (OTC:HGENF)

- Another Canadian company and a recent investment of Valsef Capital went through a similar sales and a marketing restructuring. That company is Halogen Software. From Q4 2015 to Q4 2016 Halogen increased Ebitda margin from -7% to 15% while reducing sales and marketing margin from 50% to 37%; all while growing revenue 9%, not reducing it.

- Halogen is merging with Saba (a Vector Capital portfolio company). EV/Sales = 2.3x. Arguably Halogen Software is worth more. The lower acquisition price we believe is because Michael Slaunwhite who owns 32% of Halogen is reinvesting his entire ownership into the combined entity.

Upland valuation, a ESW Capital company as a Proxy

- Interestingly Upland Software traded as low as 1.2x EV to sales and now trades at 3x EV/Sales and EV/Ebitda = 18x and a Forward EV/Ebitda of 12x assuming that the business will operate at 20% Ebitda margin.

- Upland return = 100% from 2015/2016 lows

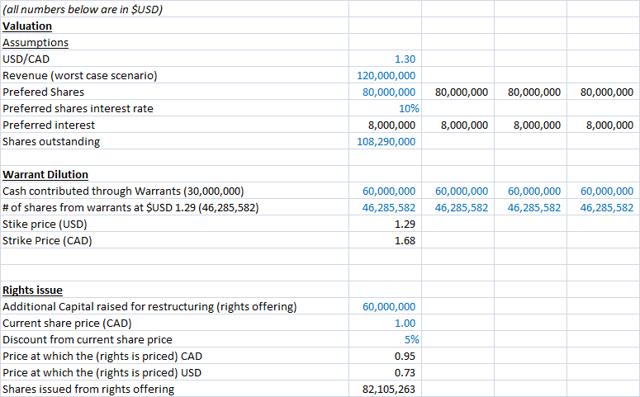

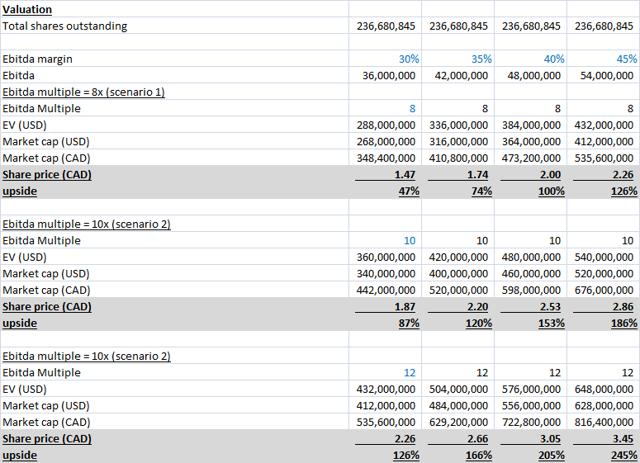

Redknee Valuation Assumptions

- Cash in hand = USD$31.54 million

- Total cash required for restructuring = $60 million

- Capital raise required = 60 - 31.54 = USD$28.46 million. Since "ESW Capital + Redknee" have been poor communicators, assuming USD$60 million in additional capital= USD$91.54 million in capital available for restructuring.

- It seems high for a company that had revenue of $152 million in 2016 revenue and $120 million in revenue visibility. Let's run with it.

- Assume all cash is used in the turnaround process and working capital requirements for ongoing business

- Warrant dilution kicks in when the share price crosses USD$1.29 (at USD/CAD = 1.30, the strike price is CAD$1.677). That is a 68% upside from current share price of CAD$1.00 before warrant dilution comes into the picture.

- Result:

- Redknee has an upside potential that ranges from 47% (Ebitda Margin =30%, EV/Ebitda =8x) to 245% (Ebitda Margin =45%, EV/Ebitda =12x)

- Capital raise required = 60 - 31.54 = USD$28.46 million. Since "ESW Capital + Redknee" have been poor communicators, assuming USD$60 million in additional capital= USD$91.54 million in capital available for restructuring.

Risks

Investor communication: There is no assurance that ESW Capital and Redknee will improve communications to investors in the near future. It could be 6-12 months before the results of restructuring start showing.

Risk of Dilution:

- ESW Capital has estimated that USD$60 million will be required for restructuring the business to profitability. Given the lack of confidence among investors as is reflected by the sharp decline in stock price, any equity raise through rights offering or otherwise will result in ESW Capital acquiring most of the newly issued shares. This may result in ESW Capital owning more than 50% of the common shares outstanding. Valsef expects a capital raise in the range of $30 million to $40 million in the form of a rights offering but has used $60 million in the valuation assumption.

- Should the Redknee share price cross USD$1.29 = 1.677 (at USD/CAD = 1.3) ESW Capital has the option to exercise warrants for USD$60. ESW % ownership after warrants are exercised will be 39.1%, assuming it do not increase its ownership in the capital raise for restructuring.

ESW Capital Controls the Redknee Board

- As part of the preferred shares agreement with Redknee Solutions, ESW Capital has control of the Board as stated in the agreement and shown below. Common shareholders have to right to elect two independent board members.

"For so long as any Preferred Shares are outstanding, the holders of Preferred Shares ("Preferred Shareholders") shall be entitled to nominate and elect to the Board a majority of the number of directors of the Company at a meeting of Preferred Shareholders (such directors being the "Preferred Directors"). The Preferred Shareholders' nominees will (subject to certain limitations) be subject to approval by the two directors elected by the holders of Common Shares other than the Chief Executive Officer (the "Independent Directors").

"Each of the Preferred Directors shall have one vote on all matters submitted to the Board, other than the following matters that shall be subject to the approval of the Independent Directors: (NYSE:I) any redemption of Preferred Shares and any financing necessary to fund the redemption of the Preferred Shares; and (ii) for a period of four years after the Closing Date, and provided that ESW Capital does not own more than 50% of the outstanding Common Shares, any change of control transaction for which the value of the consideration per Common Share to be paid is in excess of 120% of the Warrant Exercise Price then in effect."

Disclosure: I am/we are long RKNEF.

I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Additional disclosure: In order to maximize total returns for our shareholders Valsef Capital reserves the right to make investment decisions regarding any security without further notification except where such notification is required by law. Finally, this article is free.

Editor's Note: This article covers one or more stocks trading at less than $1 per share and/or with less than a $100 million market cap. Please be aware of the risks associated with these stocks.