Since my original Redknee thesis was published on March 9, 2017, the stock (RKN.TO) has moved from CAD$1.00 to CAD$1.30 - up 30%. Redknee Solutions (OTC:RKNEF) was trading at EV/Sales of less than 1x when the first article was published. Much of the gain is likely attributed to the market learning more about ESW Capital's capacity as operators.

This follow-up thesis is intended to present our view on questions that many interested parties asked us online or in-person call. It is likely that many other interested parties have the same questions. These questions can be broadly classified into two groups:

- ESW Capital's intentions and alignment with minority shareholders. Valsef is taking a more active approach to our ownership in Redknee Solution. We have recently spoken to the board of directors regarding these concerns, and on March 24, 2017, wrote an open letter to the board.

- Redknee business and post-restructuring prospects - An area that was less of a focus in the initial thesis because it was a special situation analysis (+) A Constellation Software (OTCPK:CNSWF) turnaround case study.

It is welcoming to see many sophisticated investors take an interest in the thesis.

Addressing Unanswered Questions:

<< ESW Capital Intentions & Alignment with Minority Shareholders >>

Why has ESW not communicated cost savings and profitability information, while disclosing only lower revenue and expected cost of restructuring? Are its intentions to buy more shares for cheap?

ESW Capital has invested $80 million in preferred shares at an interest rate of 10%. It is unlikely that a software operator of its caliber would target a return threshold of 10%. It is also worth noting that most of the top management at ESW Capital, with the exception of Joe Liemandt, is now directly involved in Redknee - Danielle Royston (CEO Versata), Scott Brighton (CEO Aurea), Andrew Price (CFO Trilogy), Leela Kaza (CEO of gTeam, Quantum Retail an ESW portfolio company, CEO Accolite a technology outsourcing company in India). In light of these facts, it is fair to assume that ESW Capital would have incentive to acquire more shares of Redknee at a low price ahead of the benefits from its turnaround efforts bearing fruit.

Taking the additional ownership in the open market would seem difficult (considering they are insiders with blackout periods that prevent stock buys at different periods of time); which leaves rights offerings or equity offerings as the best ways to acquire more shares. In each of the capital raise scenarios ESW is likely to backstop the equity offering. The odds of rights offering are higher since it providers an opportunity to existing shareholders to acquire shares at a discount to the market price.

Early indications that the turnaround has begun

While searching for early signs for turnaround progress at Redknee, Accolite stood out. Accolite is a cutting edge information technology services and product development company headquartered in Dallas, Texas, with four development centers in Bangalore, Delhi, Hyderabad and Coimbatore in India. Some of Accolite's prestigious customers include Morgan Stanley (NYSE:MS), British Telecom, Alcatel-Lucent, FedEx (NYSE:FDX), Trilogy (as stated by a recruiter at Accolite, Mukesh Goswami). Interestingly Leela Kaza, who was recently appointed as Managing Director, Global Strategic Accounts at Redknee, is also CEO of Accolite.

Given Accolite's expertise in the telecom sector, it is fair to assume that Raja Kaza is going to use Accolite to perform many of the tasks currently done at Redknee in a more efficient manner.

ESW Capital could be using a John Malone Playbook:

This is not the first time savvy management has painted an uninteresting and gloomy picture of a company it is working hard at. The most famous of them all is John Malone who took advantage of the spin-off of Liberty Media from Tele-Communications which was done through a rights offering. Malone went on to make 10 times his initial investment in less than 2 years (from $50 million to $500 million). While any investor could participate, the deal was done in such a way to discourage most investors from taking advantage of the opportunity.

Joel Greenblatt explains this at length in his book "You can be a stock market genius."

The lack of proper communication that calls out lower revenue ($120 million down from $152 million) and cost of restructuring (up to $60 million) without the cost savings in many ways seem to resemble the Liberty Media (NASDAQ:FWONA) story.

Excerpts from the John Malone & Liberty Media story from Joel Greenblatt's "You can be a stock market genius" illustrate this point with more clarity.

There was a lot of noise around the spin-off (a time of maximum pessimism). The Journal reported "On a pro forma basis for the nine months ended September 30, 1990, Liberty reported a loss of $20.4 million after a preferred stock dividend requirement and a $9.77 a share loss".

- As Joel Greenblatt said "the picture of Liberty painted for most investors did not exactly shout, Come on in, the water's fine!"

- Comparison to Redknee Solutions: Redknee financials over the next 2 quarters are bound to show business losing revenue (non-core, less profitable revenue) and increasing costs (severance, transitional expenses) without the benefits which will come through in the future. Cash outlay will also be higher than most expect because ESW is likely to restructure at a pace most do not expect.

Another thought where Valsef and Joel Greenblatt agree is below.

- From "You can be a stock market genius" Joel Greenblatt states:"If John Malone was going to receive a big chunk of Liberty's upside, maybe TCI could use some of its considerable muscle to help out little Liberty.". Replace the underlined words with the Redknee context.

- "If Joe Liemandt was going to receive a big chunk of Redknee's upside, maybe ESW Capital could use some of its considerable muscle to help out little Liberty."

- Joel Greenblatt states further:"Maybe Liberty could start up its own cable channels. These new cable channels would also have a huge head start if made available to all of TCI's subscribers. Hmmm....so how many ways would all this upside be split?" Replace the underlined words with the Redknee context.

- "Maybe Redknee could start up its own acquisitions. These new acquisitions would also have a huge head start if made available ESW's infrastructure. Hmmm....so how many ways would all this upside be split?".

In sum, it is fair to assume that any further investor communication around Redknee's turnaround and strategic plan will be issued around the capital raise. If additional color is only provided along with the equity raise, there will likely be little time to study the information and decide about participation. At this point ESW Capital will likely get an opportunity to increase its ownership.

Is ESW aligned with minority shareholders? Will ESW Capital take Redknee private?

This is another concern many interested parties raised. Over the long term, there is a clear alignment between ESW Capital and other common shareholders. However, in the short term there is less alignment. We believe Redknee could very well be ESW Capital's long-term public market investment vehicle. The rationale is as follows:

The public market valuation of a profitable software company is higher than that of private company valuations. At the current size Redknee could acquire companies in the telecom software sector and other vertical markets for many years to come. This will be discussed more in the "Market Opportunity" section.

ESW Capital does not have a pressing need for more cash generating assets:

Sizing up Aurea: As per Gartner in Oct 2012, Trilogy says Aurea Software led by Trilogy President Scott Brighton will have approximately 250 employees, and 1,500 customers, and by Trilogy's estimate, $100 million in annual revenue. It has successfully acquired 9 software businesses since Aurea was launched in 2012.

A 2015 press release states that Aurea had revenue of $200 million and that Scott Brighton helped grow Aurea from $40M to $200M while vastly improving EBITDA margins and customer success. Scott Brighton says ""We see an aggressive M&A strategy as a key part of our growth."

Sizing up Versata: In June 2013, Versata acquired Ignite Technologies from Austin Ventures. The press release states, "The transaction represents Versata's 31st enterprise software acquisition since 2006. We seek to put $100mm or more to work each year in software companies ranging in size from $3mm to $100mm in revenue."

$100 million each year in acquisitions is pretty sizable. I assume Versata has to generate at least $40 million/year in EBITDA. ESW Capital has done 8 acquisition just in 2016.

In sum,

Excluding Trilogy, ESW Capital has about $300 million in revenue and at 40% EBITDA margin that would generate $120 million in EBITDA. In a public statement in 2013, it states that Versata has capacity to deploy $100M every year. This shows ESW Capital has enough private operations generating cash flow. What is missing is a public investment vehicle that can leverage the infrastructure and knowledge base that has been built in 20+ years. ESW's recent success with Upland Software shows how quickly its deployed capital can be valued higher in public market.

Concentrated Common Shareholders Ownership Outside ESW:

Invesco Canada owns just fewer than 20%, Leith Wheeler Investment Counsel owns around 9% and Valsef Capital owns just over 5% of Redknee. That is roughly 35% ownership which will be watching the progress at Redknee quietly, intently. I doubt there is much more ESW will do outside of increasing ownership in the early innings of the turnaround while the information/knowledge gap is large.

Valsef has also decided to engage in constructive activism. A public letter to the Board of Directors raising concerns is a first step in that direction.

Canadian Law & Minority Shareholder Protection:

In addition, Canadian takeover laws are quite favorable in protecting minority interest.

The Canadian Securities Administrators confirmed the adoption of a harmonized Canadian take-over bid and issuer bid effective May 9, 2016. One of the main elements is as follows:

All non-exempt take-over bids must be subject to a mandatory tender condition that a minimum of more than 50% of all outstanding target securities owned or held by persons other than the bidder and its joint actors be tendered and not withdrawn before the bidder can take up any securities under the take-over bid. The purpose of this requirement is to ensure that the acquisition of control of a target through a take-over bid will occur only if a majority of independent shareholders support the transaction."

With concentrated ownership of approximately 35% of common shares resting with experienced investors there is good protection against a hostile takeover from ESW Capital. Given these facts "take private risk" is a low probability scenario.

Relationship with DevFactory, Crossover & Other ESW Capital infrastructure.

Many of the solutions that will be used at Redknee are related to ESW Capital. DevFactory, Crossover and Accolite are related to officers of ESW Capital who are also officers of Redknee now. In our discussion with those interested in the "Redknee thesis" this was a question that was unanimously asked. While it is hard to track the granularity of these actions and transactions there is no reason why Redknee's path to recovery should not mirror that of Upland Software. In fact, given that organic growth is lower at Redknee, some of the cost items such as Sales & Marketing, R&D should be lower than that at Upland Software.

There is much more upside for ESW in Redknee as a "Public ESW Vehicle" as opposed to taking money through related party entities.

Lastly: ESW Capital won't risk Reputational Risk

ESW Capital's actions will most likely mirror that of John Malone and will not involve predatory behaviour as some fear. The logical reason is fairly simple: "Should Redknee become ESW Capital's public investment vehicle, the runway for growth is tremendous. Liberty Media and Constellation Software (with $2.12 Billion in revenue in 2016) are representative of the special situation opportunity and future prospects respectively."

"Joe Liemandt" - Legacy & Reputation

Lastly Joe Liemandt is no ordinary "Joe". He created Trilogy - one of the largest private software companies in the world after dropping out of Stanford. Very few companies are able to scale organically and then reinvent themselves as capital allocation experts. Joe Liemandt has achieved both. We believe he is among the greats that would qualify to be in the "Stanford Hall of Fame" for entrepreneurship and innovation.

So we asked ourselves the question: "Will Joe Liemandt and his group of software operators apply any back door tactic to generate some more cash for the group (which would be short sighted and under scrutiny) or will they use what ESW has built over 20+ years to generate many folds of what they have deployed?" The latter is the more likely scenario.

The Redknee Business - Upside clarity for long-term Value Creation

A successful consolidation story is driven primarily by a capital allocator management, profitable base business and competitive environment of the market that will be consolidated. A top-down analysis show that the BSS/OSS business environment is ripe for consolidation. The facts that support at are as follows:

Market Opportunity

According to the Global OSS BSS System 2016 - 2024 report Transparency Market Research; the market amounted to US$29.11 billion in 2015 and is slated to be worth US$70.97 billion by the end of the forecast period - a CAGR of 10.5%. In a separate report, Gartner states that the top 25 business support system, operations support system and service delivery platform vendors generated 62% of market revenue in 2012. The remaining market is highly fragmented with over 400+ software proving a great consolidation opportunity.

In order to gain comfort with this consolidation opportunity, Valsef built a list of all public and private software companies that serve the Telecom sector in US and Canada. The largest players such as Amdocs (NYSE:DOX), CSG System International (NASDAQ:CSGS), NetCracker, Ericsson, HP and large system integrators were then removed. The resulting subset of 181 companies mostly consisted of smaller software companies which were predominantly private.

The largest company in this list had 2000 employees. Interestingly, there were 128 companies from the list had less than 100 employees which are unlikely targets for the largest players. Redknee is in the sweet spot because even companies with 15 employees can be a worthwhile acquisition. Summary math is as follows;

Companies that can be acquired = 181# Total employees = 31,262 (This was derived from LinkedIn. Usually there are more employees than shown on LinkedIn) Revenue/employee assumption = $100,000 (This is low for a software company - Sample revenue/employee for comparable companies in 2016 are as follows)

- Amdocs = $145,464

- CSG Systems International = $229,757

- Constellation Software = $175, 272

- Enghouse Systems = $223,014

- SSNC Technologies = $185,156

- Total revenue available for acquisitions = $3.12B

Assuming 3% to 5% of the total revenue base can be consolidated over the next few years, it translates to $93 million to $156 million in revenue that can be acquired by Redknee. A similar opportunity should be available in rest of world (Europe and other regions) Excel file with list of companies, # employees, location has been attached

Case Study on Turnaround/Restructuring: Constellation Software's acquisition of Maximus Inc.'s Asset, Justice, and Education solutions businesses ("MAJES")

Below are sections from the shareholder letters that Mark Leonard, CEO of Constellation wrote about the business and how the underlying business performed each quarter after it was acquisition. These notes have many similarities to Redknee Solutions.

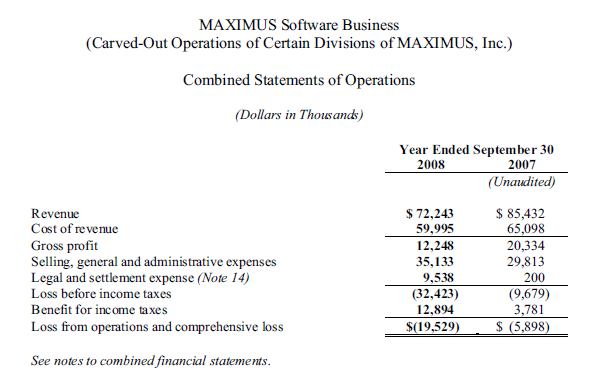

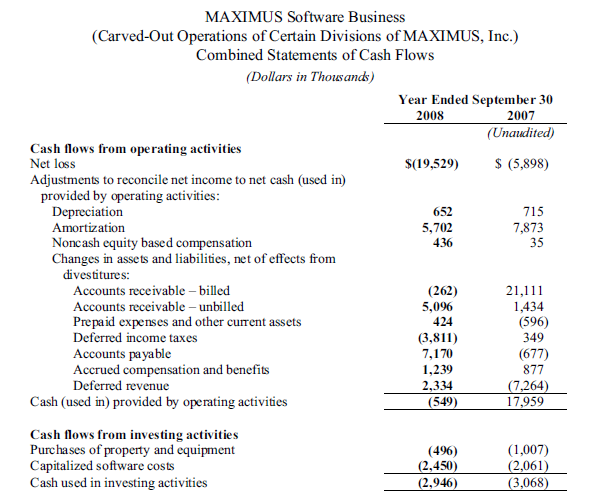

Mark Leonard Q4 2008:"The BAR (Business Acquisition Report on MAJES) did, however, throw into question our sanity. Read literally, it suggests that we bought a business that had $72 million in revenues and lost $32 million pre tax in the year leading up to our acquisition. According to the BAR, the business also had a negative tangible net worth (excluding deferred income taxes) of $2 million. For this we paid $40 million. Clearly we had quite a different perception of these businesses than that depicted in the BAR."

Mark Leonard Q1 2009:"GAAP and even our own "Adjusted EBITDA" measure do a poor job of reflecting the current economics of the MAJES acquisition. In an investor's shoes, I'd look at the cash purchase price ($35 million disbursed to date) and compare it with the cash produced ($1 million in the 6 months that we've owned the business). Not bad, but certainly not up to our long term expectations, and nowhere near as good as the reported six month Adjusted EBITDA ($8 million) and Net Income ($3 million) for these businesses would lead you to believe."

There are several large contracts within MAJES that are cash flow negative, and until they are either completed or terminated by the customers, we don't expect attractive returns from the acquisition."

Note: Constellation is hoping for revenues to reduce - In similar fashion as Redknee thinks revenue can be around $120 million and that is actually a good thing.

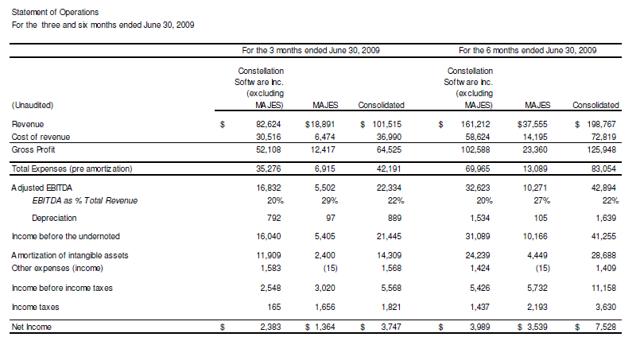

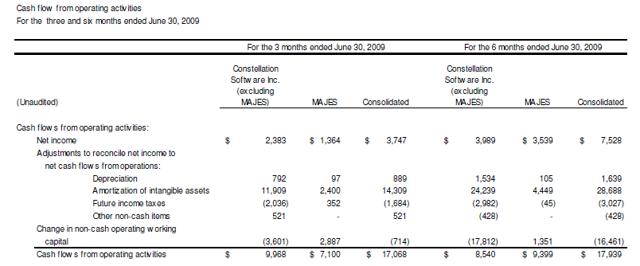

Mark Leonard Q2 2009:"The Maximus Asset Justice and Education solutions ("MAJES") businesses that we acquired in Q3 of 2008 contributed significantly to revenue ($19 million), Adjusted EBITDA ($5.5 million) and cash flow from operating activities ($7.1 million) in Q2 2009. This was the first quarter where the MAJES cash flows suggest that the purchase price that we paid might be reasonable. It is still too early to congratulate ourselves, as contract penalties and/or contingent liabilities assumed as part of the acquisition could yet reverse the positive cash flows achieved to date." Snapshot of MAJES Financials from the Business Acquisition Report is below.

Snapshot of Financials 3 Quarters into Constellation Software operations (reference MD&A Q2 2009):

This case study is to illustrate 2 things:

That the financials will certainly look bad for about 2 quarters before it starts getting better. It goes to show that best practices in software work irrespective of the vertical. "MAJES" is in a completely different vertical than Redknee's telecom software, but constellation with over 200 business units in many different verticals shows how best practices are vertical agnostic. ESW Capital too works in many verticals.

Another Look at the Potential Future Profit Margin

Many questions we received revolved around what operating margin and % of revenue different cost items would be under ESW. The first "Redknee Thesis" was focused on how ESW Capital achieves profIt margins higher than some of the well operated software companies. Here the illustration will be one that is derived from two of the most direct comparables, without giving any credit for ESW's low cost infrastructure. Redknee faces direct competition from Amdocs (predominantly telecoms), CSG International (predominantly cable and satellite), Oracle (NYSE:ORCL), network infrastructure provides such as Ericsson (NASDAQ:ERIC), Huawei and to a lesser extent IBM (NYSE:IBM), TCS, Infosys (NASDAQ:INFY) and Accenture.

Both Amdocs and CSG Systems boast high recurring revenue. While Amdocs does not explicitly disclose %recurring revenue, CSG states that recurring revenue is around 90%. Redknee too should have a high %recurring revenue once the low and unprofitable revenue is let go by ESW Capital.

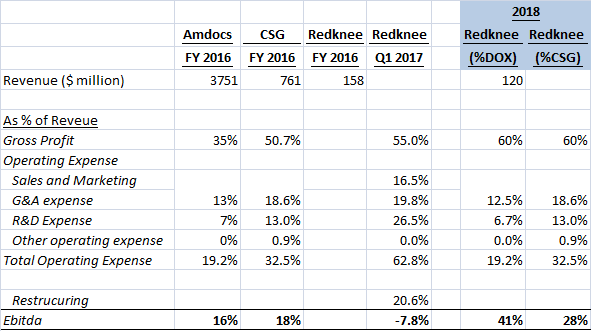

If Redknee Operates at Amdocs, CSG Levels

To begin with Redknee has a higher gross margin despite having smaller scale than both Amdocs and CSG Systems International. Many of the questions around the first article were around what the individual cost line items would look like. It is hard to precisely estimate this, but below is a high level view of how it can be. Both Amdocs and CSG have resources in low cost centers, but not to the same extent as ESW, which is about 90% outsourced.

Assuming that revenue drops from $158 million in 2016 to $120 million in 2017/2018 the gross margin should improve from 55% to around 60%.

In its 2016 annual report Amdocs states the following: "Managed services engagements can be less profitable in their early stages; however, margins tend to improve over time, more rapidly in the initial period of an engagement, as we derive benefit from the operational efficiencies and from changes in the geographical mix of our resources."

Amdocs uses its scale advantage to outsource work to low cost centers such as India. It also has a lot of managed services which are lower gross margin revenue. However, Amdocs has a very strong services organization that runs the monetization process at some of the largest CSPs in the world and the service is of recurring nature. Redknee, on the other hand, is predominantly software revenue and hence the overall business should be more profitable. CSG also uses low cost centers but to a lesser extent than Amdocs.

In conclusion,

Redknee investment has two levels of opportunity:

- A John Malone style special situation in the making

- A clear roadmap to profitability, and pipeline opportunity in telecom software once the turnaround takes hold

The risk of lack of alignment is to a large extent mitigated by:

- Concentrated common share ownership outside of ESW Capital, and strong Canadian law protecting minority shareholders

- Active involvement of a large shareholder in Valsef Capital, who also has software operational knowledge.

Supporting Documents

Disclosure: I/we have no positions in any stocks mentioned, but may initiate a long position in RKNEF over the next 72 hours.

I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Additional disclosure: In order to maximize total returns for our shareholders Valsef Capital reserves the right to make investment decisions regarding any security without further notification except where such notification is required by law. Finally, this article is free.

Editor's Note: This article covers one or more stocks trading at less than $1 per share and/or with less than a $100 million market cap. Please be aware of the risks associated with these stocks.